Estimates operating losses at Rs 14,000-24,000 crore for the quarter, says EY-Ficci report

Hyderabad: With the outbreak of Covid-19 in India and stipulated lockdown, the private healthcare sector is experiencing severe stress, with expected short-term operating losses to the tune of Rs 14,000 to 24,000 crore for the quarter, according to a EY-Ficci study.

For the hospital sector, which is already constrained with liquidity, onset of such losses will cause cash balances to be completely depleted within a month. The revenue for the sector in FY21 is also expected to be lower by 20-35 per cent compared to FY20 resulting in early single digit or negative earnings for the full year. The private hospitals and nursing homes constitute more than 60 per cent of beds (at 8.5-9 lakh beds) 60 per cent of inpatients and 80 per cent of doctors in India.

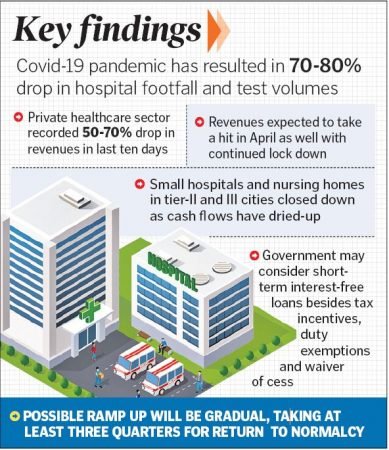

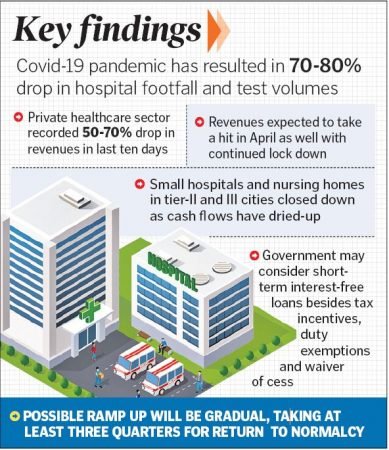

The private healthcare sector has witnessed an 80 per cent fall in patient visits and test volumes, and revenue drop of 50-70 per cent in end March. Occupancy levels have fallen to a mere 30-40 per cent by late-March compared to pre-Covid occupancy levels of about 65-70 per cent, which is expected to further deteriorate this month. EY and Ficci studied median performance across 91 private healthcare players.

The sector is witnessing a slowdown as per the EY-Ficci study titled, “Covid-19 impact assessment for private healthcare sector and key financial measures recommendations for the sector.”

Dr Sangita Reddy, president, Ficci and joint MD, Apollo Hospitals Enterprises, expressed that the private healthcare sector in India has stood beside the government firmly to contain the virus and is deeply committed to the war against Covid-19. However, there is an urgent need to consider the healthcare industry’s triple burden–low financial performance in pre-Covid state; sharp drop in out-patient footfalls, diagnostic testing, elective surgeries and international patients across the sector is impacting cash flow; and the increased investments due to Covid-19 which has impacted the hospitals and laboratories like never before.

Recommendations to govt

Ficci and EY recommend short-term interest-free, concessional interest loans to cover operating losses; immediate release of Rs 1,700 crore dues locked with Central and State governments; Indirect tax reliefs, exemptions and waivers such as recoup amount equivalent to ineligible GST credits paid on procurements estimated at Rs 2,000 crore for three months; customs duty, GST exemption on essential medicines, consumables and devices for treatment of Covid patients.

In addition to waiver or reduction of health cess on medical devices, the study recommends extension of time under the Export Promotion Capital Goods scheme for three years; recoup income tax refunds by adjusting taxes payable and tax dues; to declare tax deducted at source as NIL on payments from government authorities and insurance companies for FY21 and set at 5 per cent for FY22; deferment of statutory liability payments such as TDS, PF, ESI, GST without interest and penalty for 3-6 months; rebate on commercial rate of power for a stipulated period. Estimated power cost for the sector is Rs 7,000 crore; and waiver of renewal fees for licenses along with option for renewal on self-certification basis to speed up the process of bed capacity addition.