Hyderabad: Even as the conventional real estate asset classes are getting back on their feet post the pandemic, two new asset classes are seeing a sudden spurt in demand — data centres and warehouses.

The forced shift to e-commerce to enable the contactless business to fulfil social distancing norms has created the need for more warehouses and logistics centres. Hyderabad, being the distribution hub in Telangana, is also seeing increased traction in the warehousing segment, according to real estate consultancy KnightFrank in a report ‘Work from Hyderabad’ that it launched on Wednesday.

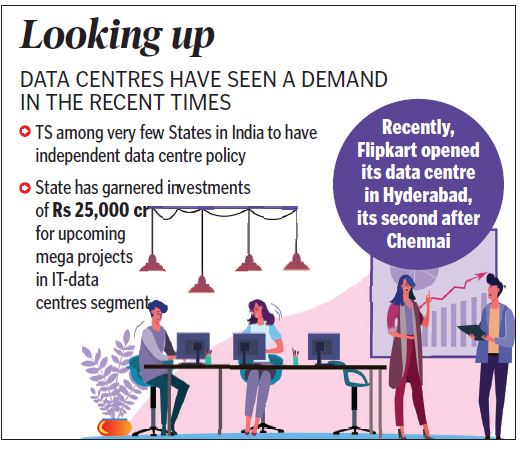

Data centres have seen a demand in recent times. IT sector is an anchor industry of Hyderabad, data centres are not a new concept for the city. Telangana is among the very few states in India to have had an independent data centre policy, as early as 2016, it said. The government has been effectively promoting its seismologically safe geography and high quality, cost-effective infrastructure to attract data centre investments in the State.

Telangana has already garnered investments of Rs 25,000 crore for upcoming mega projects in the IT-data centres segment, highest across industries. Recently, Flipkart opened its data centre in Hyderabad, it’s second after Chennai, to support its core operations, the report said.

Office space

Hyderabad’s commercial real estate market has seen a growth of 172 per cent in its transaction volumes between 2014-19. Its share in all India sales has increased from 11 per cent in 2013 to 22 per cent in 2019 when the city recorded its highest ever transaction volume of 12.8 million sqft in the office market (second highest after Bengaluru).

Hyderabad is now home to marquee names like Google, Amazon, Microsoft, Apple, Facebook and IKEA. While business process outsourcing and knowledge process outsourcing are still important, the focus now is on captive production and product development functions.

Investments

As a result of Telangana’s efforts to facilitate an investor-friendly environment, Hyderabad has seen private equity investments to the tune of $2.1 billion (six per cent of the total investments of $35.2 billion across India) in the real estate during the period 2015 to 2019. About 90 per cent of the investments are in the office segment while the remaining is divided between retail and warehousing segment.